Ibbotson and Sinquefield: The Elements of Modern Portfolio Theory and the New "Science" of Asset Class Allocation

Paul Samuelson's Inconvenient Revelations

Paul Samuelson, Nobel Laureate in Economics, and who in the late 1940s (to Harvard's eventual great embarrassment) was denied tenure and moved down the Charles River to MIT, was finding ways to reduce economic concepts to mathematical equations. As he studied the available statistical information on stock market investment returns, he began to understand that over the long term, active manager portfolio results tended to fall below the market's mean performance. In his more or less universally adopted, college-level economics teaching text Economics (now in its 25th edition), and in a number of subsequent white papers focusing on investment, Samuelson began to suspect that "the mob," as he characterized public and professional money manager players, over the longer term could never hope to rise above the mean return achieved in any given segment of the market, or for that matter the market as a whole.

Markowitz and Sharpe and Quantitative Investment

In his PhD thesis in 1952, Harry Markowitz introduced the observation that ultimately one's portfolio return had something to do with the risk assumed, and initiated the study of price volatility as a proxy for risk. So began the quantitative assessment of risk and the attempt to optimize the relationship between an investor's willingness to assume risk and the expected return. Markowitz, regarded as the father of Modern Portfolio Theory (MPT), was awarded the Nobel Price in 1990, but attempts to use computerized optimization models to build so-called efficient portfolios in practice never seemed to realize their potential.

In 1964, Bill Sharpe (later to be awarded a Nobel Prize in Economics) further defined the price of risk, fine-tuning the Capital Asset Pricing Model (CAPM) and introducing his Sharpe Ratio (a method for determining how much risk an investor has taken to achieve each incremental measure of portfolio return).

In 1965, Paul Samuelson and Eugene Fama independently published papers putting forth the concept of the Efficient Market Hypothesis (EMH), a market environment in which stock market price action reflects all known information at a given moment about a company and further theorized that stock market price action exhibited nothing more than fully random behavior.

These observations were later developed by the likes of Burton Malkiel, Jack Bogle's close associate, in his classic finance book A Random Walk Down Wall Street, published in 1973. Malkiel's and Bogle's paths crossed while both were at Princeton, where Bogle wrote his honors thesis on the future of the mutual fund business. Adjusted for management fees of 80-100 basis points, this inability to better the mean return provided by the stock market is an inconvenient statistical truth that persists throughout virtually all unbiased research into investment market behavior to this day.

Otto Eckstein Builds DRI's Econometric Model

In the early 1960s, with Samuelson's approach in mind, Professor Otto Eckstein and a group of his PhD candidates at Harvard developed the Data Resources (DRI) econometric model of the US Economy. This model simulated the interaction of some 2,700 dependent economic variables. Their objective was to forecast macro-economic outcomes that could be used by economists, portfolio strategists, and managers. However, he recognized that the limitations of computing resources at that time made it too difficult to develop logic that could be used to represent the impact of the all-important variables of sentiment, public policy, and geopolitics.1 With marketing finesse he turned this weakness into an advantage and a sales bonanza by opening and requiring the user to input their own assumptions for these three important variables, thus offering user "control" over the model's predictions and output. McGraw Hill eventually acquired DRI for $120 million in 1979 ($600 million plus in today's dollars).

AG Becker Funds Evaluation Service

Early in the 1970s, Stuart Gassel at Paul Judy's AG Becker launched the firm's ground-breaking Funds' Evaluation Services to track and report manager portfolio performance. Leasing NASA's massive mainframes in Des Moines during the graveyard shift, this monthly and quarterly service for the first time revealed the true time-weighted, fully cash-flow-adjusted, total rate of return profile of a client's account. As Becker's client base broadened it became possible to benchmark performance relative to a universe of other client portfolios with similar objectives, as well as with the relative market indexes of the day. The survey's results were often a wake-up call for many retirement plan sponsors attempting to earn an assumed rate of return in the corporate and public retirement fund field. In the Endowment world, trustees could finally begin to measure the effectiveness of retained portfolio managers entrusted with the institution's and donor's financial resources.

Charley Ellis Forms Greenwich Associates

At about the same time, Charley Ellis formed Greenwich Associates (GA) in southern Connecticut. With Becker's Funds Evaluation approach in mind, GA peered further into the unfilled void of information about an investment management firm's business models, broker-dealer underwriting practices and trade execution capabilities, banking services, insurance company financials, as well as the quality and effectiveness of Wall Street research. Institutional consumers of these financial services were thereby becoming better informed purchasers, but not yet the public.

Ibbotson and Sinquefield's Landmark "Big Data" Study

In 1976, Roger Ibbotson and Rex Sinquefield published their ground-breaking article titled Stocks, Bonds, Bills, Cash and Inflation (1926-1974) in The Journal of Business. It was, in a sense in today's AI world, the Big-Data platform for much of the academic and Wall Street research on liquid asset class pricing behavior which followed. The long-term upward trend in past securities returns was finally quantified in detail. That led to the understanding that price risk (volatility), return, and a whole host of other factors were also dependent variables. Although a truism today, for statisticians the data to prove that greater risk usually yielded greater returns was finally available. The whole field of computerized quantitative investment market analysis was more universally enabled.

Ibbotson and Sinquefield's compilation of this essential historic securities pricing data base facilitated the further development of:

- Capital Market Theory and the Efficient Market Hypothesis (markets are efficient and reflect the sum total of all information at any instant in time)

- Modern Portfolio Theory (how risk-averse investors can optimize expected return at any given level of market risk)

- The "New Science" of Asset Class Allocation

Asset Class Allocation Determines an Essential Element of Portfolio Performance

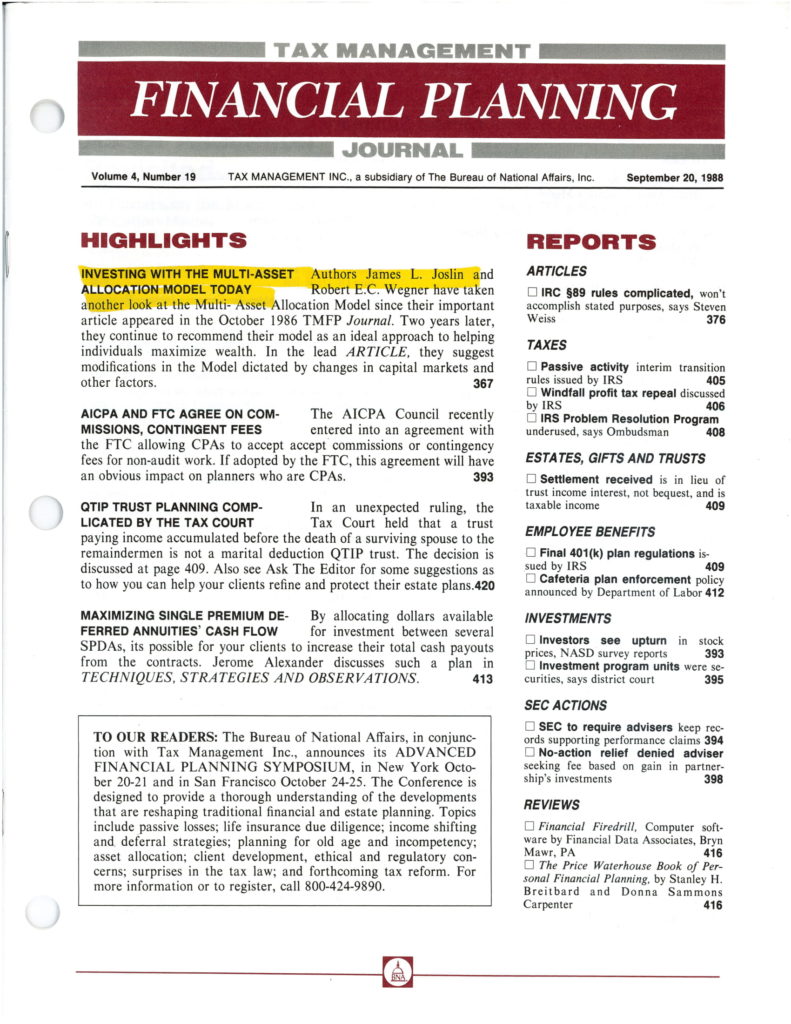

The 1986 Beebower, Brinson, Hood paper, "Determinants of Portfolio Performance" was widely misunderstood, misrepresented, and unashamedly exploited by many in the portfolio management marketing and product sales communities. It led to refined computerized portfolio optimization models, so-called "Quant" approaches ("black box" algorithms), and ultimately today's financial technology (FinTech) pursuits. In 1988, Bob Wegner and I authored articles in the BNA Tax Management Financial Planning Journal on "Investing with The Multi-Asset Class Model" (see Appendix), as well as conducting a series of symposia in Boston, New Orleans, and San Diego on how this approach could be applied to the personal HNW services market.

Promising Much, But Delivering Sub-Par Results

Computerized asset allocation models proliferated, promising all sorts of investor benefits - some efficacious, but most falling short of their implied outcomes. Today's reductio ad absurdum equivalent is a cell phone app one can use to "beat the Market with Turn-Key Style Box Models uniquely designed to fit a user's investment preferences."2 With this app, a user can chose from 25 portfolio-asset class mixes (from Large Cap Growth to Small Cap Value). The modeling algorithms underlying this app will also suggest when to rebalance investments back to a specified fixed mix every two or three months. However, these attempts to take the human behavior element out of the portfolio management equation, as with most computerized efforts attempting to beat the market (even with sophisticated artificial intelligence algorithms), have yet to consistently deliver excess returns above the mean (less fees).

____________

1 Harvard College Lecture 1962, "The Economics of Taxation"

2 iQuantpro

Sign The Guestbook

The author welcomes your feedback. Please sign the Guestbook to let us know of your visit to this website. There is a place to offer your suggestions, comments and/or questions.